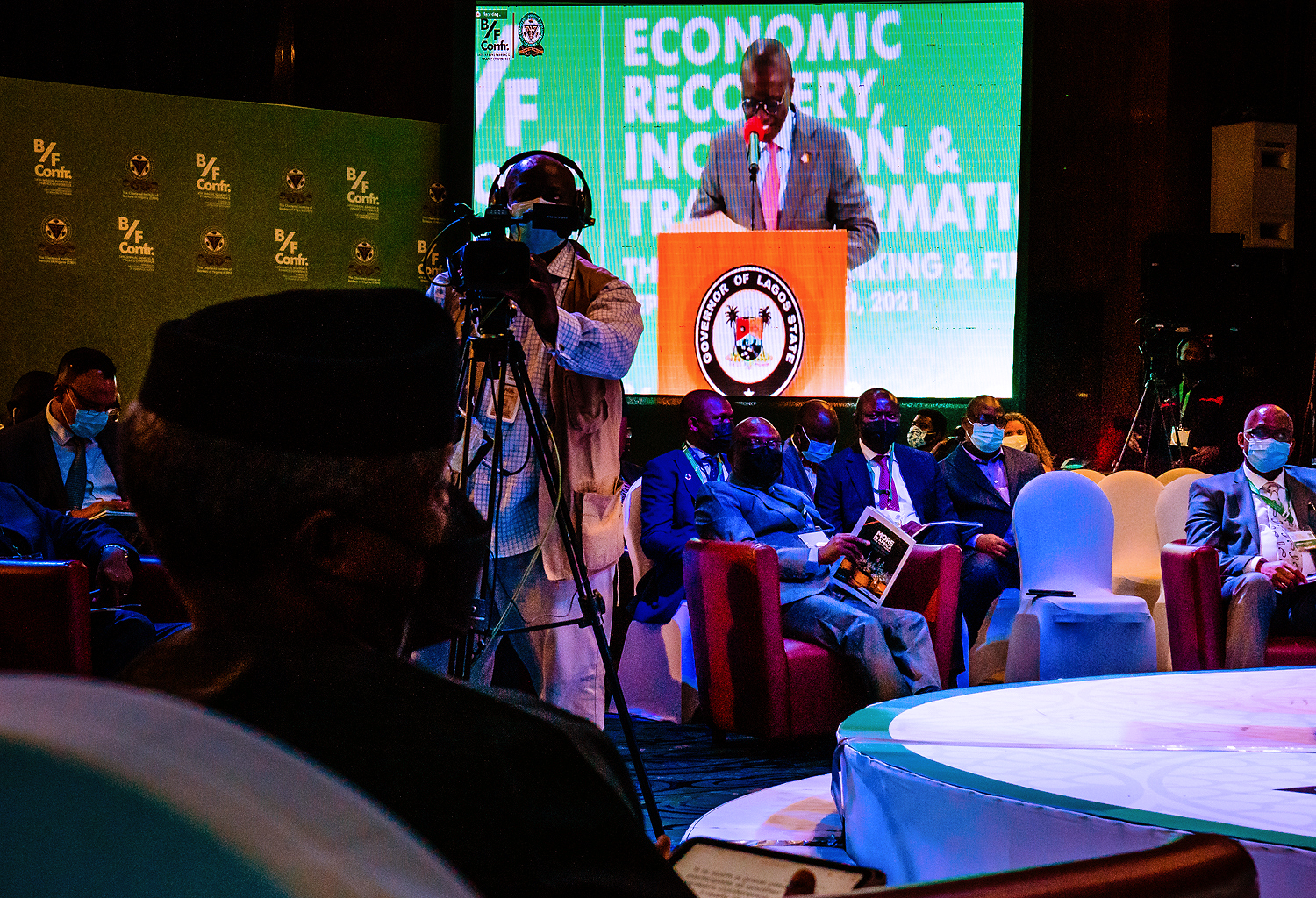

14th Banking & Finance Conference Themed: “Economic Recovery, Inclusion, & Transformation, Role Of Banking & Finance”

REMARKS BY HIS EXCELLENCY, PROF. YEMI OSINBAJO, SAN, VICE PRESIDENT, FEDERAL REPUBLIC OF NIGERIA, AT THE 14TH BANKING AND FINANCE CONFERENCE, HELD AT THE TRANSCORP HILTON HOTEL ABUJA, ON THE 14TH OF SEPTEMBER 2021

PROTOCOLS

It is such a great pleasure to participate at another Bankers’ Conference, the 14th. And I must say that I really like Bankers’ Conferences, they are always so encouraging. Bankers always look good no matter how things are looking, sharp business suits, ladies and gentlemen bankers. They just look recession-proof.

But I must say that your confidence and optimism is a patriotic act, it is not just a reflection of the fact that yes there is plenty of opportunity and plenty to do, but also a patriotic act. Talking of patriotism, one of the most patriotic Nigerian I know is my dear younger brother, the CBN, Governor Emefiele. (Tells a short story of Emefiele’s act of patriotism).

So, I am glad to be here, of course, everyone here will agree that the past few years have seen some of the most economic shocks in our history. We have had the misfortune of experiencing two recessions in about four and half years due to external shocks notably from the oil sector and now from the health sector with COVID-19.

While we must commend ourselves for quickly exiting both recessions and even seeing a 5.01% GDP growth bounce back in the last quarter, we have experienced a deepening of poverty and unemployment. If there is any issue that must be front and center of policy and action today, it must be lifting millions out of poverty, creating jobs and opportunities for our young, and restless population. Every macroeconomic and government policy must be subjected to the question, what will its impact be on poverty and jobs?

This is why the theme of this conference is particularly important, “Economic Recovery, Inclusion and Transformation, the Role of Banking and Finance.”

I will in the next few minutes, hopefully, challenge our banking and financial sector to step up to the plate and play its part. And this sector has a large part to play.

First, because we know that countries with better developed financial systems experience faster economic growth and as such, are better able to engineer accelerated exit out of poverty for many. Second, according to a McKinsey Report, despite COVID, Africa’s banking sector is fast-growing and nearly twice as profitable as the global average.

To be fair, over the years, the banking and finance industry in Nigeria has supported national economic development in so many ways. It has provided good-paying jobs to a large number of Nigerians and contributed to growth in economic activities through path-breaking innovations. And as we have heard from the President and also from the CBN Governor, several innovative interventions have greatly helped in ensuring that we are able to sustain some of the progress that was made through the years and even to make some appreciable progress despite the challenges of COVID-19 and other external shocks. But clearly, we are far away from where we ought to be.

So what else needs to be done?

I believe that it is time for the banking sector to take on some of the transformative big-ticket items that would fundamentally transform our economy. Such matters for example, as consumer finance but housing finance in particular.

The link between housing, housing finance, and economic development is already well established. (And there is an interesting AfDB survey that provides great material on this point and I have used it quite extensively).

“The housing sector may support poverty reduction and inclusive growth in two general ways. First, housing construction contributes to economic output, creates employment, and generates a demand for materials and related services. Second, improved housing raises the standard of living of occupants. That study (AfDB survey) says for example that the benefits of housing for individuals accrue in large part through better health and sanitation, and of course, this improves the overall human capacity of our citizens who are able to own these houses.

Housing also generates large multiplier effects in terms of employment and output. Employment is created for both skilled and poorer, unskilled workers. The evidence also suggests that there is a symbiotic relationship between housing finance and financial sector development. Housing finance helps to develop the financial sector itself and helps to contribute to economic growth. So, these were the justifications that we also advanced for our mass housing initiative in the Economic Sustainability Plan.

But the challenge for full implementation of our mass housing programme remains that the finance sector appears shy or simply has not found the right housing finance model that will work. Because we do not have a functional mortgage market, we are way behind in homeownership. And our economy is effectively left out of perhaps the most reliable source of generating capital for individuals.

I admit this is not a task for banks alone, there are issues around the appropriate pricing of mortgages. Today given treasury bill rates, banks would rather take those safe investments. Mortgages would then have to be at a premium significantly higher than the treasury bill rates. Banks had also argued that sterilizing their assets as non-interest-bearing cash reserves, plus AMCON rates at 0.5% impairs not just liquidity, but also return on assets. But in fairness to the CBN, as I will mention shortly, they have allowed the use of banks Cash Reserve Ratio, CRR, to support and de-risk development projects.

Then there are also land titling issues, problems associated with perfecting property titles, which are problems only State governments can solve. We have been working on these issues with several State governments, in particular, some of the best work we have done has been with Lagos and Kano under our Ease of Doing Business initiatives.

Another issue that I think must engage your attention now is some of the game-changing interventions that the financial sector can make in light of the extensive implications of climate change mitigation.

The world is committed to zero emissions by 2030. One of the chief considerations especially for developing countries is how to pay for the massive transition to renewable energy. How do we pay for moving from where we are, especially fossil fuel-based power sources to renewable energy? This is a significant challenge but it is also an enormous opportunity.

The Federal Government established an integrated solar strategy for the electrification of 5 million households, serving about 25 million Nigerians, in the Economic Sustainability Plan. The CBN set aside N150 billion for the program made available through Banks’ CRR via a program administered by the Central Bank of Nigeria.

The program has three core objectives expanding increasing energy access to 25 million individuals (5 million connections), increasing local content in the off-grid solar value chain, and creating about 250,000 new jobs. The program is targeted at three key players including assemblers (or manufacturers), distributors, and vertically integrated off-grid companies.

There are two proposed mechanisms for the disbursement of low-cost funding to component manufacturers and off-grid companies under the programme. This includes, for component manufacturers, direct lending through selected commercial banks or local Development Finance Institutions (DFIs) such as Bank of Industry and Development Bank of Nigeria.

The second is for off-grid companies, direct lending from local Development Finance Institutions (DFIs) to SHS distributors and mini-grid developers through a CBN credit facility which is collateralized by pledged revenues and repaid through cash sweeps.

The Federal Government also provided subsidies of up to 20% to 30% for each successful installations through the Rural Electrification Agency/World Bank Nigeria Electrification Programme (NEP) to further de-risk the transactions. The NEP program has been ongoing for the past two years with record collections of 90% and above in some cases for NEP Solar Developers showing a relatively low-risk track record.

Despite these efforts from the Federal Government, there has been little uptake by Commercial Banks to catalyze installations or manufacturing for #SolarPowerNaija. The pioneer transaction was a partnership between Sterling Bank and the Niger Delta Power Holding Company (NDPHC), that saw the NDPHC provide further risk guarantees to get the project through.

The challenge of under-electrification of the rural and poor and its associated impacts on our economic well-being and security cannot be overstated. The climate change challenge is a massive one in more ways than we can imagine. I would like to encourage the Bankers Committee to refocus on supporting the Solar Power Naija to ensure that in the next few months, we can catalyze access to the N140 billion and create 5 million connections that can multiply to eliminating our electricity access deficit and creating jobs.

We are on the cusp of adopting our new medium-term development plan, the banking and finance sector is expected to help mobilize the additional resources that the public sector requires for plan execution.

Moreover, given its traditional role of financial intermediation, the banking sector has a critical role to play in providing the capital required for the private sector to drive economic growth.

I would only add that the sector should also introduce more long-term and patient financial arrangements and instruments which are essential for building infrastructural facilities and factories needed for structural transformation.

Government is already playing its part in this regard through the establishment of development banking institutions such as the Bank of Industry and the Development Bank of Nigeria and special purpose vehicles like the Infrastructure Corporation of Nigeria (Infraco) and the Investing in Digital and Creative Enterprises programme which we are implementing with the African Development Bank.

Going forward, the banking and finance sector must take advantage of the new opportunities that are opening up and also adapt to domestic and international developments. The rapid changes in the technology sector mean that financial technology companies and payment service companies are now an inescapable part of the banking and financial landscape.

To start with, banks must leverage the Nigerian Interbank Settlements System (NIBSS) and the Biometric Verification Number (BVN) to their advantage as both are sources of data and of secure transactions. One particular area in which these advantages can be used is the provision of credit to businesses and individuals.

The availability of the data on clients across the banking sector enabled the Central Bank of Nigeria to issue the Global Standing Instruction policy which makes it possible for banks to recover their loans from recalcitrant borrowers by attaching their funds in other banks. This policy should significantly reduce the risk of non-performing loans and enable banks to begin to extend personal and business loans on a wider basis.

Financial inclusion is of course critical to the objectives of recovery, inclusion, and transformation. Access to financial services especially in this COVID era is particularly important for the poor and more vulnerable sections of society so that they can keep their micro-businesses alive and handle risks and uncertainty.

Again, we must commend the CBN, the Bankers’ Committee, and the CIBN for the efforts made towards developing the Shared Network Expansion Facility (SANEF). This facility is one that has worked very well especially in incorporating mobile payment technology firms into our banking and financial system. And it has helped a great deal in ensuring that you don’t need to get a banking license before you are able to participate one way or the other.

I must also acknowledge the banking sector for the very critical role that you have played in the delivery of the Federal Government Social Investment Programmes by making it easier to make payments to beneficiaries of the scheme across the country in several locations that otherwise would have been impossible.

However, there is a lot more that needs to be done. 39% of current banking agents are in rural areas. One obvious way to rapidly scale up financial inclusion is clearly to leverage mobile technology. And the more room that you can give to these payment systems, the better for us all.

Making headway in this context entails innovation and cross-sectoral collaboration between the banking and telecommunications sectors especially with regard to providing products that are tailored to different customer segments. I have had a few tension-filled meetings between the banking sector and telecommunications companies. I suspect that the bankers think that the telcos are about to take their lunch. And they are generally very skeptical about the ways that the telcos come into the financial sector.

But inclusion demands coming up with products that suit various parts of a diverse and heterogeneous market, and the truth is these banking and financial services must be open to others, in any event, technology has made it now inevitable. As part and parcel of this effort, banks should work with governments and other stakeholders to promote financial literacy so that people have the knowledge that they need to make the right financial decisions.

I think banks must also step up to the plate in the context of the African Continental Free Trade Area (AfCTA). One of the reasons why I think this is important is the involvement of bankers, especially at the negotiation stage. As we negotiate now, rules of origin and other segments of the negotiation will impact the way that we enforce, the way that we carry out and take advantage of the free trade area agreements. I think that banks must at this stage come into that process of negotiation and be with negotiators because quite a few of the advantages, especially with services, are going to really belong to the banking sector.

So, we think that with increasing trade means increasing opportunities. So, the AfCTA means more opportunities, especially for cross-border payments. We already have a fairly visible presence of Nigerian banks across Africa with the likes of Access, UBA, Zenith, and GTB in several countries and there is no reason why we cannot expand on this using the opportunity provided by the free trade agreements.

Similarly, it would be important to develop inter-regional and continental payments systems to facilitate the expected increase in goods and services under this free trade agreement.

I expect that the proposed Pan-African Payments and Settlement Platform being established by Afeximbank will garner the necessary support from the finance industry so that we can at least have a system that works for cross-border payments across Africa.

As I close, permit me a little reflection. I think that banking has been one of the most stable industries for centuries. Not much seemed to change from one phase to the other. But the next decade and it may be much sooner, promises to bring about the most fundamental changes we have seen yet. This is evident from the rise of fintech companies, the role of digital currency whether issued by reserve banks or crypto, blockchain technology, the increasing role of venture capitalists especially in providing equity for startups, the preference of these companies for equity rather than debt may be worth thinking about, however, no matter how things pan out, I think we have interesting days ahead.

Let me again thank the Council of CIBN and the Organising Committee of the 14th Annual Banking and Finance Conference for the invitation extended to me and also for the excellent arrangements made to convene this meeting successfully.

Thank you for very much for listening.