4th Impact Investors’ Foundation Annual Convening On Impact Investing

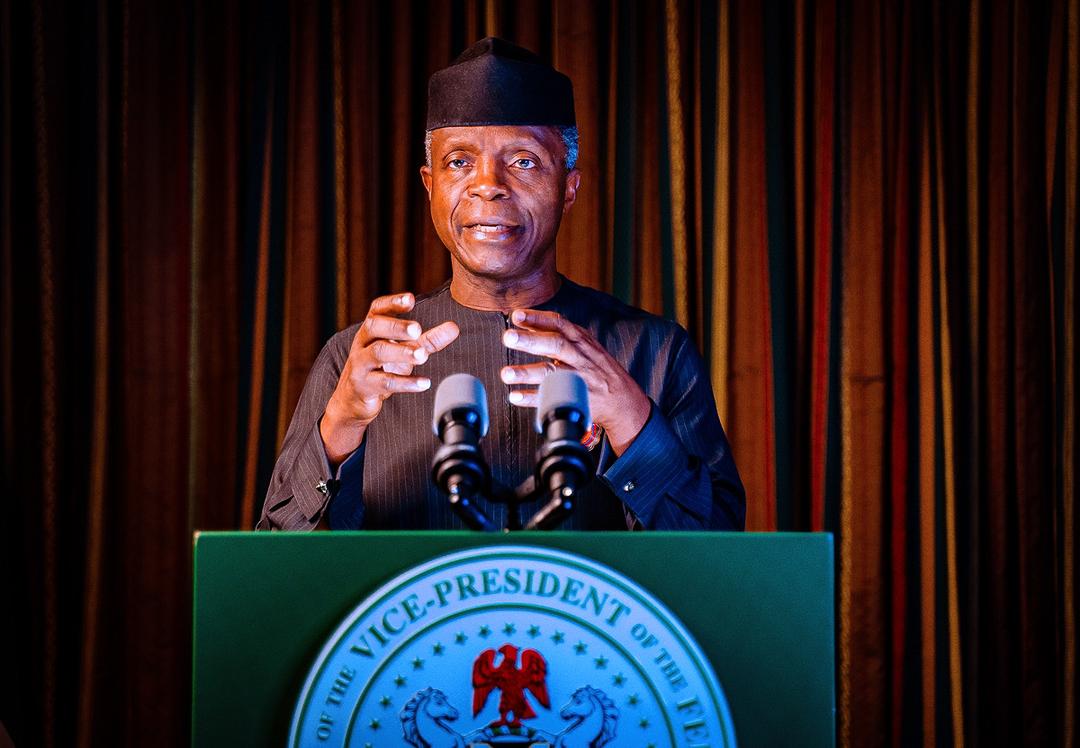

VIRTUAL KEYNOTE ADDRESS BY HIS EXCELLENCY, PROF. YEMI OSINBAJO, SAN, GCON, VICE PRESIDENT OF THE FEDERAL REPUBLIC OF NIGERIA AT THE 4TH IMPACT INVESTORS’ FOUNDATION ANNUAL CONVENING ON IMPACT INVESTING ON THE 9TH OF NOVEMBER, 2021

PROTOCOLS

Let me thank very much Mrs Ibukun Awosika, the Chairperson of the Nigerian National Advisory Board for Impact Investing for the kind invitation to join you at this 4th Impact Investors’ Foundation Annual Convening on Impact Investing, and also to say a few words on the theme of the meeting.

I know that impact investing was very close to the heart of my dear friend and brother, Innocent Chukwuma of blessed memory, who in his capacity as the Regional Director of Ford Foundation West Africa helped to establish the Impact Investors’ Foundation and I take the opportunity to pay tribute to his memory.

Innocent was passionate about development and about building a better and more equitable society, so it is not surprising that he was closely associated with this noble idea.

I also think that the entire membership of the Impact Investors’ Foundation (IIF) deserves our commendation for keeping the flame alive. Certainly, the very ability to attract several notable and highly respected Nigerians and institutions to serve on the National Advisory Board for Impact Investing is a testament at once to the importance of the subject matter and to the commitment that you all have to promote impact investment in Nigeria.

Liberal economies assume that growth, including a decent standard of living for the people, will be driven largely by commercial entities motivated by profit, who create jobs and pay taxes. But the evidence suggests that even in the wealthier nations, too many are left behind and inequities continue to grow. Of course, this is worse in societies such as ours where poverty is significantly higher, population growth rate consistently exceeds the capacity of the economy to produce sufficient jobs.

I think it is also quite evident that some of the most lucrative businesses in the economy, oil and gas, and banking and finance, do not produce jobs commensurate to profits they make. And only a few, relative to the population, benefit from the huge dividends that are declared.

Glaring inequalities of wealth and opportunity in the face of poverty, misery and social alienation in any society is asking for trouble. Such a situation is neither sustainable nor wise. The sharp drop in standards of living caused by COVID-19 induced shocks to our economy and economies worldwide have not only further deepened existing inequalities but pushed many more into extreme poverty.

Neither governments nor businesses can afford to ignore the huge social disparities and environmental deterioration for long.

But because the logic of the profit motive as being the driver of innovation, wealth creation and growth is unassailable, the real question is how to ensure that it accommodates a moral compass. Or put differently, that a more sustainable business model is intentionally built into the profit-making objective, the means of attaining society’s social and environmental goals. The notion of doing well by doing good or harnessing the forces of innovation, entrepreneurship, private capital to achieve both profit, social and environmental good.

Impact investing is an eminently sound approach to balancing these inequities “by catalyzing social and environmental impact for long-term structural change.”

I think some of the current models of impact investing we are seeing are not only inspiring but also point in the general direction that policy and regulation should go. I will take two examples each from the private sector and government to demonstrate the point.

There is a digital agriculture company called Farmcrowdy. The company has a platform that allows individuals to securely invest in farms online, enabling them to participate in agriculture indirectly. Investors’ funds are used by Farmcrowdy to offer rural farmers improved seeds, farm inputs, training and a market for their produce. Investors get back their investment with an added percentage return. Farmcrowdy’s processes include:

- Investors register on ‘FarmShop’ either through the company’s website or the mobile app.

- Investors pick the farm they want to invest in and get information on investment, duration, return on investment, harvest period etc.

- Investors are able to track the activities of the Farm via the mobile application or website with images and videos posted to their dashboards.

- After the farming cycle and harvest, Farmcrowdy pays back investment amounts and return into electronic wallets on investors’ dashboards.

- Farmcrowdy uses a profit-sharing model, where it splits the post-harvest revenues among farm investors, farmers and itself, Farmcrowdy retains a 20% portion of those profits.

All initial investments are insured.

This is a model of impact investing in agriculture using digital technology effectively.

The other example in the private sector is Andela, the highly successful technology company that recruits and trains local software engineers at little or no cost, who in turn work remotely for them (Andela) for various global companies, thereby generating good-paying jobs for thousands of young people. Andela in September this year became a Unicorn when it raised $200 million from investors led by SoftBank Group Corp., a Japanese tech investor.

So, profit and sound social and environmental benefits can co-exist.

Governments of course can be facilitators of impact investment. Two examples – the first, in 2017, the government launched the first sovereign green bond in Africa and the fourth in the world. Proceeds of the bond as the name implies can only be used to finance climate environmentally friendly or enhancing projects as approved by the Securities and Exchange Commission.

Government’s action, in this case, was important because it took the risk of investing in a debt instrument in the locally and internationally uncharted waters of environmental finance. This is as it should be. A government bond is probably the one confidence enhancing mechanism for encouraging climate finance. The second example of government leadership in impact investing is our SolarPowerNaija programme. This is a major component of our Economic Sustainability Plan, in response to the severe economic fallout of the COVID-19 pandemic. The programme is providing 5milion homes with electricity through solar home systems and mini-grids. The programme has three core objectives: expanding increasing energy access to 25 million individuals (5 million connections), increasing local content in the off-grid solar value chain and creation of 250,000 new jobs.

The programme is targeted at three key players including assemblers (or manufacturers), distributors and vertically integrated off-grid companies with the provision of four main interventions including concessionary debt-funding to all players, CBN FX window to manufacturers and assemblers, tax relief through import duty reduction on raw materials or semi-knocked down components and leveraging complementary programmes like the World Bank NEP for grants to distributors.

There are two proposed mechanisms for the disbursement of low-cost funding to component manufacturers and off-grid companies under the programme including for 1) component manufacturers, direct lending through selected commercial banks or local development finance institutions (DFIs) to manufacturing entities backed by an off-taker agreement with SHS distributors or mini-grid developers. 2) For off-grid companies, direct lending from local development finance institutions (DFIs) to SHS distributors and mini-grid developers through a CBN credit facility collateralised by pledged revenues and repaid through cash sweeps.

It is clear that there is a great deal that is possible in impact investing both from the private and public sectors. But there is a long way to go from the relatively random investment landscape we have now to a more orderly space where government regulations and incentives are carefully worked out with stakeholders.

The point in the spectrum occupied by impact investors between the not-for-profit end, the Environmental Social and Governance, ESG, and for-profit entities is still essentially a virgin space. How can we incentivize these investments and how can we properly measure impact in order to assess fair incentives? There is clearly here an opportunity for collaborative thinking between the government and the impact investing community and other stakeholders on policy and regulations.

In closing, let me state that the Impact Investors’ Foundation is certainly off to a good start. I commend partners like the Ford Foundation, Bank of Industry, African Capital Alliance, BusinessDay Media and Dalberg Advisors for their efforts to establish the Foundation in order to promote impact investment in Nigeria.

I can see from the line-up of presenters and panellists that the concept of impact investing is gathering the required interest and momentum from important stakeholders.

I extend my very best wishes as you discuss how to expand impact investing in the economy and I look forward to receiving the outcomes of this convening.

Thank you all very much.