VP Osinbajo’s Presentation At The Mid-Term Ministerial Performance Review

PRESENTATION DELIVERED BY HIS EXCELLENCY, PROF. YEMI OSINBAJO, SAN, GCON, VICE PRESIDENT OF THE FEDERAL REPUBLIC OF NIGERIA, AT THE MID-TERM MINISTERIAL PERFORMANCE REVIEW, HELD AT THE STATE HOUSE BANQUET HALL, ABUJA, ON MONDAY, OCTOBER 11TH, 2021

PROTOCOLS

Let me just begin by saying that I hope we will be able to see a full presentation and we’ve received copies of the full presentation. That is already on the monitor. What I will do is simply speak on the presentation and refer to a couple of slides to save time.

At the end of 2019, our economy was looking very good indeed. We had had four quarters of consecutive GDP growth, and all the fundamentals, the macroeconomic fundamentals looked excellent, and we were well on our way to much faster growth. Then COVID-19 struck.

And if we go to slide 4, you can see the devastating impact on the economy. Our GDP contracted to (minus) -6.10% during the second quarter of 2020. Oil price, at one point, fell even below production cost, to about 10 dollars a barrel, and then finally settled at about $45 per barrel during the second quarter of 2020. The official rate of the Naira was devalued from N305 to a dollar ($1) to N360 to a dollar, and then to $380 to $1 by the 3rd quarter of 2020. Unemployment went up to 33.3% in the fourth quarter of 2020.

In slide 5 As you can see, there were sharp declines in some key sectors:

- Transportation sector declined by 49%

- Hospitality sector fell 40%

- The Education sector fell 24%

- Real Estate declined by 22%

- Trade by declined by 17% and

- Construction declined by 40%

So, clearly, we were in a terrible economic situation, and all brought upon us by the pandemic. I think it is very important to put in context just the enormity of the shocks that we experienced. Because even a 5% decline in any sector of the economy is significant. So, clearly, when you get a 40% decline, like in construction, or 49% decline in the transportation sector, that is deep, especially when the country was just pulling out of an earlier recession. And this is also in the context of the security challenges that we are facing in different zones of the country. So, the total picture at the time was certainly very dire.

In response, the President took two actions. The first was to set up a small inter-ministerial Committee headed by the Minister of Finance to quickly examine the implications and the immediate mitigation steps that would be taken for the economic shocks we were experiencing. The second step which Mr. President took was to ask that we draw up a full Economic Sustainability Plan to provide at least a 12-month response to the fallout of the pandemic. And Mr. President asked me to chair the Committee to draw up the plan and later to implement the plan.

We were clear that the only way – Mr President’s position also – that the only way of avoiding an economic disaster that could last for years was for the government to essentially put forward a major fiscal stimulus plan; with clear objectives of saving jobs, creating new ones, supporting businesses that may close down, and employees that may not be paid during lockdowns, and, of course, healthcare support to reduce the COVID-19 caseload.

So, the objectives of the plan are set out in slide 8. The first was improved healthcare and lowering the COVID-19 caseload, the second was Restoring Growth; the third is job creation and safeguarding existing jobs; the fourth – increased local production, and part of that was what we called the Guaranteed Offtake Scheme; the fifth was Reducing Social Vulnerabilities, and that essentially was looking at how to improve the quality and effectiveness of the Social Investment Programmes and the scope of the programme.

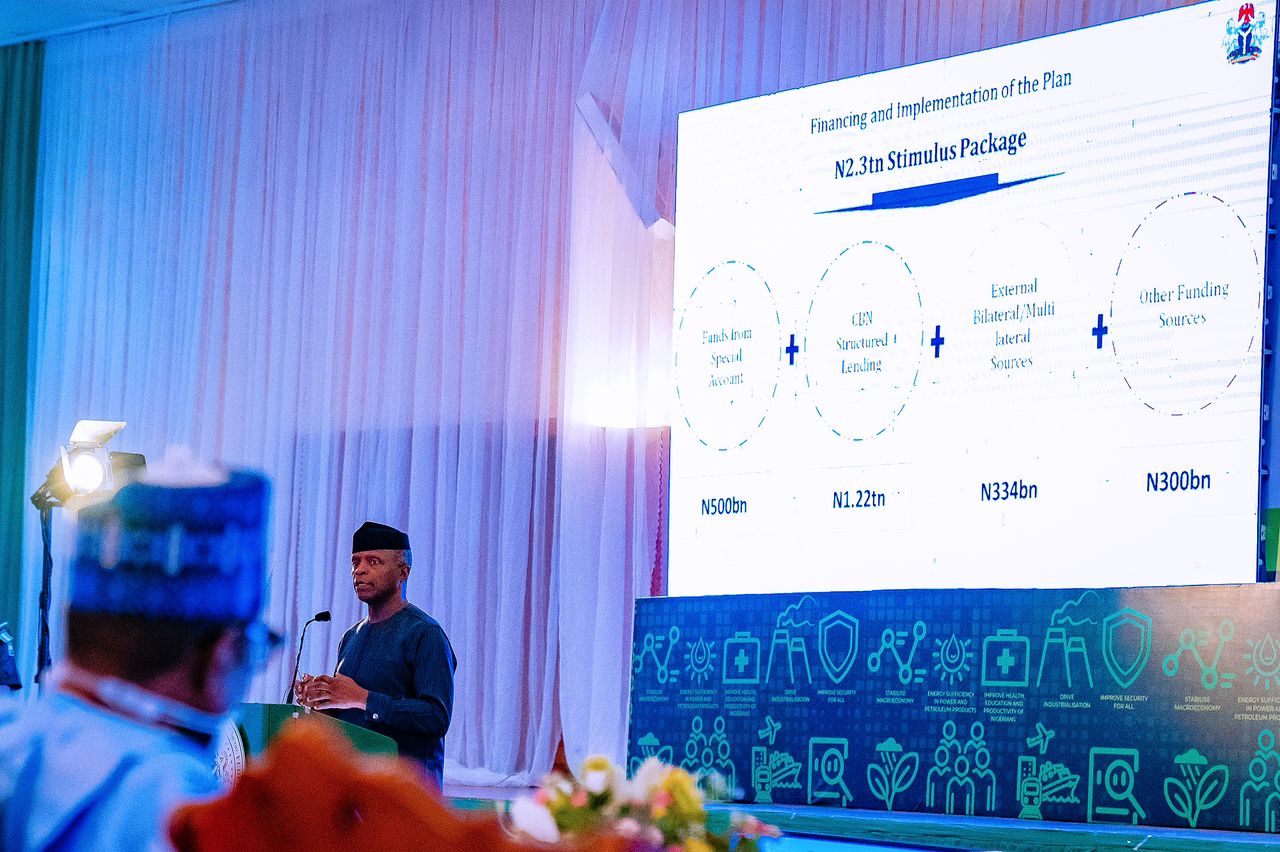

The size of the stimulus or cost of the plan was N2.3trillion. And Slide 10 will show us how we planned to raise the N2.3trillion. This was all very carefully worked out. At the economic Sustainability Committee, we looked very carefully at the different models and how much money we thought would be able to get us back into growth and out of recession quickly. And we were assisted by the NBS, and, of course, the Ministry of Finance also assisted greatly in setting up a model that could describe and tell us as nearly accurately as possible how much would be required to get us out of the recession, and of course to get us back to a path of sustainable growth.

So, the sources of funding, after we had decided it was N2.3 trillion, were one: from Special’ Accounts – N500bn. Now, these Special Accounts is just a way of describing different government accounts that we thought we could draw from. Essentially, what we were doing was wiring money from different government accounts and pulling them into one account so that we could use that as the first bit of money that we could get in order to finance the N2.3 trillion. Then, there was structured lending from the CBN to the tune of N1.22 trillion. Now, this lending, of course, is completely different, this lending was supposed to come through CRR, through the banking system itself. So, essentially, what we are getting from the CBN was lending to banks which would then be lent to the businesses and the sectors of the economy that we thought would require the lending. Then (funding) also from bilateral and multilateral agencies – N334billion; and other funding sources – N300billon. I will come back to slide 11-13 later.

We set up some priority clusters, areas of activity that could be grouped together for planning purposes. And in Slide 9, you would see the Priority Clusters. The Priority Clusters were mitigating the Shocks. How do we mitigate the shocks, the immediate steps to be taken? Tackling vulnerabilities, which is, of course, the Social Investment Programmes; Job Intensive Interventions – in other words, programmes designed to create and sustain jobs. We’ll come to that in a moment.

Then rescuing businesses, which was the MSMEs Survival Fund etc. Then, Repositioning the Economy. And we then took also what we described as Crosscutting Imperatives for a post-COVID economic recovery. We thought that perhaps it was also an opportunity for us to do certain things, put certain things to the fore; which even after our initial interventions, and getting away from the economic shocks, would be required for us to be able to put the economy on the path of sustainable growth.

The 6 priority clusters enabled programmes to be compartmentalized in buckets with clear targets.

In slide 14, we have some of the Fiscal and Monetary Measures which were taken to help mitigate the impact of the pandemic.

The fiscal measures included the extension of the deadline and suspension penalties for filing late returns, for example; the Conversion of World Bank $82 million REDISSE programme to support COVID-19 interventions in the State. We asked the World Bank to allow us to convert that $82million programme to give individual states money so that they could build up their healthcare facilities, set up their laboratories and do a few other things that were required as emergency measures and the World Bank consented to that. So, we were able to distribute the $82m to the different states.

The Provision of N86billon intervention fund for health infrastructure. And that came directly from our N500billon from the Special Account.

Payment of an incentive package for frontline healthcare workers. That also came from the N500bn. And then the Grant of an additional moratorium of 1 year on CBN intervention facilities. The CXCBN facilities that have been given to various businesses, the CBN graciously consented to a one-year moratorium for payment. They were then able to defer payment on their loans for at least a year. Of course, that was subsequently extended when we found that that would not be adequate.

Then, there was a reduction in the interest rate on intervention facilities which the CBN had given, from 9% to 5%, as part of the plan to make life easier for businesses.

There was also a grant of regulatory forbearance to banks to give borrowers some breathing space, including through restructuring of outstanding debts. In other words, businesses that wanted their loans restructured, businesses that felt they were no longer able to keep up the payment of their loans to banks, the CBN gave a regulatory forbearance; in other words, allowed the banks to be able to look at their loan structures and restructure where that was required. In other words, the CBN granted a forbearance on non-performing loans. These are some of the interventions.

The CBN also reports the disbursement of N798bn to 3.9million smallholder farmers under the Anchor Borrowers Programme. Now the Anchor Borrowers programme was not a part of the Economic Sustainability Plan in that way, but it obviously affected the way that, first of all, the general amount of money that was released to the system. And, of course, it was a continuous programme, and it flowed also into the Economic Sustainability Plan.

There was also another N134.6bn to 38,140 beneficiaries under AGSMEIS scheme, and N343bn to 726,158 beneficiaries – I’m looking here at CBN’s own direct interventions; and the release of N1tn to 269 real sector projects in all. N103bn disbursed to 110 healthcare projects. Now, these, of course, are the CBN’s own releases, CBN’s own interventions.

Some of the fiscal measures were taken to safeguard oil revenues, mobilize and preserve non-oil revenues and rationalize government expenditure. These were steps taken essentially by the Ministry of Finance.

But a major component of the plan was, of course, to build a resilient healthcare system and this remains a critical objective as the pandemic is still raging.

So, if you look at Slide 15, the funds allocated to the Health Sector were for:

- Surveillance and Epidemiology

- Establishing Laboratories

- Point of Entry Management

- Infection Prevention and Control

- Case Management

- Health-related Communication

- Research and Development

After full implementation, what we expect to see, although already, we’ve seen several of these; 52 Federal Tertiary Health Institutions (FTH); the availability of adequate PPEs in all Federal Tertiary Health institutions; 520 ICU beds; 52 isolation wards with 1,040 beds; 52 Molecular Laboratories to carry out, on the average, 150 PCR tests every day.

I think it is important to point out that these are Federal Government’s interventions, these are not State’s interventions. Of course, the States were also building up their own capacity. But what I have just described are the Federal Government’s own specific interventions and the results of those interventions.

Of course, we know that Vaccines are being administered across the 36 states in Nigeria today. And as of 28th September 2021; 4.8m people or 4.3% of the eligible population had received the first dose of vaccine; while 1.9m people or 1.8% of the eligible population had received the second dose. We have also received and are expecting significant quantities of vaccines in the coming weeks and months.

I’ll go now to the MSME Survival Fund. As I noted earlier, one of the first things that we considered was rescuing businesses, keeping businesses afloat. And the particular programme that was designed for this was designed by the Ministry of Industry, Trade and Investment; and it was described as the MSME Survival Fund.

Now, if you go to Slide 16, this is the layout of the programme. The programmes were designed to create jobs and safeguard existing jobs. We had the:

- The Guaranteed Off-take Scheme

- The Payroll Support Scheme

- The Artisan & Transport Support Scheme

- The General MSME Grant Scheme and then Formalization Support Scheme.

The MSME programmes had in all, as of today, supported 1.1m people and businesses as follows:

Direct grants were given for a three-month period to 459,000 beneficiaries across the country. In other words, the salaries of 459,000 beneficiaries were paid for a three-month period. We had representation from several sectors. For example, private school teachers. There is an association of private school teachers, they were very interested to ensure that teachers remain paid within the period. Of course, public school teachers were being paid. Private school teachers also wanted to be paid. So, they formed a significant portion of the 459,000 of those who were paid as part of that fund. So, beneficiaries received N90,000 and N150,000 in salaries for the three-month period.

Then 293,000 transport workers and artisans received one-off grants of N30,000 each

Then, from the MSME General grants – 82,000 businesses also received one-off grants. And then, 255,000 enterprises benefited from the CAC free registration of companies, called the Formalization Scheme. What simply happened here is that if a person wanted to register their company, 255,000 of them were allowed to register those companies free, and the federal government paid for the registration.

Then, we had the agric programme called the Agriculture for Food and Jobs Plan. This is in Slide 17. It is also a major pillar of the Plan. Because we thought that mass agriculture, doing something extra for agriculture would essentially provide jobs and food. Part of that programme was the enumeration of farmers and we enumerated 6.39 million farmers and these farmers were geotagged to their land. So today, we have accurate records, verified by the Ministry of Communications and Digital Technology. With their farmlands geotagged.

So far, 3.63million passed the first stage of validation and another 2.47 million passed the second stage of validation. We’re validating them also for BVNs, those who do not have BVN are getting it now and all of that.

Also, 320 hectares of land has been cleared across 8 states at 40 hectares per state. There are several states are involved in the project. The States are Kwara, Plateau, Cross River, Edo, Kaduna, Ekiti, Osun, and Ogun. These are States that require land clearing. Of course, many States do not require land clearing, and we simply supported those states directly. ₦ 471billion is allocated as loans to farmers across 14 Crop Value Chains, Beef Production, Aquaculture and Poultry Farming.

But so far, only ₦14billon has been disbursed to commercial banks and even this sum is yet to be utilised by farmers due to the late release for the 2021 wet farming season. I’ll come to that in a moment, because we’ve had some complications, especially with the structured loans that we’re supposed to get, coming from the CBN to the commercial banks.

Then we have the Fertilizer Subsidy Programme, which is a very important and critical part of this Food for Jobs programme. Prior to this, what has happened is that fertilizer and paying for fertilizer, which assists farmers, has always been a problem. This programme was designed. Mr. President approved a programme of giving subsidies to farmers for bags of fertilizers to each farmer depending on the size of the farm. But the strategy here was to give the farmer the amount of the subsidy directly in cash paid to their BVN verified account. Each farmer that was going to get the subsidy would have this money paid directly to his BVN verified account. Mr. President approved the immediate disbursement of the Fertilizer Subsidy Fund to Small Holder Vulnerable Farmers in the country.

A subsidy of N5.billion was paid to 1,013,126 farmers. This is lower than previously reported due to the removal of 184,977 farmers who did not have BVN’s verified accounts.

But the subsidy payment is evidence-based and tied to the farmer enumeration process. A farmer receives 4 bags of NPK per hectare, so a farmer with 5 acres or 2 Hectares gets a subsidy of N24,000 paid directly to his account for the 8 bags of NPK needed. A farmer who owns 1 acre or less gets a subsidy of N3,000. As I said, this is paid directly to the farmers. That has helped a great deal in ensuring that subsidies actually get to the farmers and they are able to benefit directly from the subsidy. When they buy, and they can go anywhere to buy their NPK, which is already available. But rather than relying on sellers, third parties or anybody to provide that subsidy, they already have the subsidy. So, when they go to buy, they already have between N3,000 and N24,000 in credit.

The next is the Social Housing Programme, which was designed to create thousands of jobs and boost the local building materials industry. The whole idea was to build 300,000 houses and so far, we have about 1,151.689 ha of land that has been made ready for development. This has the capacity to accommodate a further 34,550 homes.

The Programme is being funded by a mix of resources including financing from the Federal Ministry of Finance under the Family Homes Fund, and a loan from the Central Bank under the ESP which is supposed to be in the order of N200billion. Buyers have a window of at least 15 years to pay for their homes.

The design is to build two-bedroom homes costing not more than N2 million; N3.75 million for a three-room unit, and N4.25 million for a four-room unit. There were many arguments – it wasn’t possible to build a home for N2 million but we have not only tested it, but we have built it. As a matter of fact, Borno State has built 8,000 units, and they are way ahead of others. The homes are designed to meet the cultural needs of the place where they are built.

In Borno, for example, the way the houses are structured is completely different from the way they are structured in Nasarawa. Borno State has shown and set an example that it is entirely possible to do this and build very quickly, using local raw materials, using local artisans and doing so at great speed.

At the moment, 4,700 homes have been approved in 7 States for financing for commencement in October. Another 5,400 are scheduled for November 2021. Progress has been much slower than envisaged, there are continuing delays in the disbursement of funds between the CBN and Commercial Banks. The Debenture Agreement for the sum of N200 billion with the CBN, which represents the bulk of the financing, was agreed in April and we are still waiting for disbursement to fully commence.

The Solar Electrification Programme is another limb of the creation of several jobs, and at the same time, adding value to the quality of lives of people. Also, to develop local solar industry, even as it increases energy access through 5 million new solar connections.

It will include the assembly or manufacturing of components of off-grid solutions to facilitate the growth of the local manufacturing industry, while the use of local content will be encouraged. We expect that in all, it should create 250,000 new jobs in the energy sector.

For funding purposes, the programme has been broken to 5 categories; N57 billion in guarantor projects. In other words, we are asking some of the Federal Government agencies such as NDPHC, NNPC to guarantee certain portions of the whole programme. In effect, the producers and installers of the solar connections can go ahead and connect N57 billion worth of solar products upon the guarantees of these two agencies.

There is the N20 billion in small scale downstream, N20 billion in commercial bank upstream projects, and then N28 billion for state-guaranteed projects (Adamawa, Akwa Ibom) and N15 billion in commercial bank downstream projects. When I say guarantee, they are not putting cash on the table, but they are placing guarantees with commercial banks to say that if money is not paid back, then they are the primary obligors.

The way that this works is that each solar connection is not a free gift because it is installed by a private solar company. What happens is that where a solar connection is made, the recipient of the solar connection makes payment on a monthly basis. What we found out across the country is that so long as power is steady, everyone is ready to pay. The rate of default is almost zero. We had experimented with this previously in several markets, for example, in Sabo Gari in Kano State and Ariaria in Abia State where we had thousands of stalls installed with solar power and there were no rates of default. In any event, if you default, your connection is cut off. It is an effective programme and those who have benefitted from it are happy with it and it is also a sustainable programme.

Unfortunately, again funds have also been slow in coming and we have had difficulties with accessing most of the funds because, again as I mentioned before, these are CBN to Commercial Banks and then to Private Companies that have to do the work.

Of the N140 billion allocated, so far only the received N7 billion has been disbursed for use by the programme. N42billion worth of transactions has been closed (fully deployed, to be delivered, and guaranteed) which will lead to 704,000 connections. A further N46billion of transactions are in very advanced stages and will lead to a further 600,000 connections. We expect that in the next coming weeks and months, we will be able to move very quickly on the solar connections as the banks are able to get more confident to be able to give those funds which the CBN is supposed to guarantee.

The key challenge, as I have said, is with disbursement coming from the CBN to the commercial banks and then to the users of the funds.

There is also a risk aversion of public and private financial institutions, particularly for power projects in addition to limited knowledge about the off-grid market and its potential. But I think that over time, we are working through this and I am confident that we will get to a point that people will have more confidence in the whole process and be sure that their money will come back when they give it out.

Lack of access to Foreign Exchange for the importation of systems and raw materials is also another major problem.

Then we have the Public Works and Aviation segments of the plan (in Slide 20) where we have all that is going on in the public works programme. About 193 road sections totalling 3,707km of roads is ongoing. 26,021 Nigerians have been employed in the rehabilitation/construction of these roads so far. The construction of 345km of rural roads, 205 boreholes and 10 treatment plants to create jobs and develop rural areas.

I think it is important to understand that the Public Works programme was one that was designed to create jobs in the midst of the COVID-19 pandemic to sustain those who would be unable, for one reason or the other, to feed themselves during that period, and a lot of benefits is derived from that. As a matter of fact, the Hon. Minister of State for Budget and National Planning, Prince Clem Agba, went around looking at some of these public work projects and sent back photographs and videos showing the tremendous amount of work that had been done and the number of people that had been engaged.

In 36 States and the FCT, already road constructions are at 98% completion with 204 km completed. 774,000 youth have also been engaged by the National Directorate of Employment (NDE) in the Public Works Programme.

In aviation, N5 billion was allocated for local airlines, ground handlers and other aviation-allied businesses aimed at easing the negative economic effects of the pandemic. The breakdown is as follows:

- Scheduled operators got N2.84 billion

- Non-scheduled operators (cargo and private jet services) – N949 million

- Ground handling operators – N233 million

- Inflight catering services – N233 million

- Aviation fuel operator – N233 million

- Travel Agents – N196 million

- Airport car hire – N196 million

What are the outcomes of the plan so far? I think it is fair to say that the plan helped us to avoid a much more painful economic challenge, and we must commend Mr President for his foresight and for acting quickly, first in setting up the committee to assess the damage and very quickly to the establishment of the Economic Sustainability Plan and having a detailed plan with funding, and approving the plan expeditiously so that we can move quickly. But for the speed with which this was done, things would have been worse. It enabled us to get out of the recession in record time and much faster than most economies in the world. You would find that most economies of the world were scrambling trying to find one solution or the other, trying to determine what a fiscal sustainability plan would look like. We were able to move quickly under the direction and leadership of Mr President and we were able to put together our plan and act on it quickly.

Revenues improved despite oil production issues; macro indices are also trending in the right direction. If you have looked at our GDP report, you’d find out that things are looking up.

Revenues year-on-year federation revenues in Q2 2021 are up by 6%, albeit much lower than projected in the budget due to problems with oil production. We are producing less than even our OPEC quota, there have been shutdowns/shut-ins in some of the wells and the various problems of getting them back up have generally tended to reduce our oil revenues as you would see in the GDP report.

Inflation has trended downward over the past 5 months, falling to about 17% during Q2 of this year. Although food inflation is very troubling and food production and supply has been affected by security challenges.

GDP growth – the GDP performance in the second quarter of this year has been a highlight with an increase of 5% year-on-year, the highest since 2015, and I think this is worth celebrating.

External Reserves – our external reserves are improving back, but will be even higher as we go along. The questions around ensuring that we are able to get the supply of dollars and again, we all have our views on that.

Our oversubscribed Eurobond this last cycle has helped also in beefing up the external reserves.

However, given record-high oil prices, the reserves should do so much better.

Sectors that have rebounded to positive growth; transportation has rebounded to positive growth of 77%, hospitality has rebounded to positive growth of 2% which used to be negative, real estate from 40% down to 4%, trade from to about 17% down now up to 23%, construction from 40% down and up now to 4%,

I will end the discussion with some of the challenges with implementing the Economic Sustainability Plan, and just a quick look at future perspectives and funding.

With respect to the full implementation of the plan, we have seen how inadequate funding has, in some ways, hampered what could have obviously been a much better performance.

Our N500 billion which was budgeted for and which we took from special accounts, was essentially the major part of the N2.3 Trillion programme. CBN interventions were also helpful, but I want to just point out that the N1.2 Trillion which is supposed to be structured loans were still very far behind and that’s a significant part of the plan. That has greatly affected what would have been an even greater outcome.

The last GDP report presented by the Hon. Minister of Finance, Mrs Zainab Shamsuna Ahmed, also highlighted major challenges to our economy; unemployment heading for 40% and loss of jobs since 2018, dwindling oil revenues on account of production shortfalls below quotas, poor foreign investment inflows both FDI and FPIs largely due to exchange rate concerns and uncertainty around repatriation of profits, and security concerns.

I think that many of these problems are completely resolvable, I don’t think that they constitute any significant difficulty that we cannot resolve. But one of the most important things is that there must be synergy between the fiscal and monetary policies, which is absolutely crucial. Sometimes it appears that there is competition, especially on the fiscal side. If you look at some of the interventions, you’d find that those interventions should be managed by ministries.

The Ministry of Industry, Trade and Investment should handle MSMEs interventions and we should know what the CBN is doing. In other words, if the CBN is going to intervene in the MSMEs sector, it should be with the full cooperation and concern of the Ministry of Industry, Trade and Investment. That synergy is important, and aside from that, you cannot plan an economy in any other way, the more important thing is that sometimes, you will get people who are benefitting more than once because we have no line of sight to what is going on one side.

As for the exchange rate, we need to move our rates to be more reflective of the market as much as possible. This in my own respectful view is the only way to improve supply. We can’t get new dollars into the system when the exchange rate is artificially low. And everyone knows by how much our reserves can grow. I am convinced that the demand management strategy currently adopted by the CBN needs a rethink.

On the whole, we have been able to weather the storm of a very serious economic challenge and I think that is largely on account of the stable and steady leadership that we have received from Mr. President. I think that if Mr President had panicked in that period, we would have had a lot of difficulties and perhaps, we would have been in a much worse situation. I think Mr President deserves all the commendation for providing that steady hand when it was required.

I think that we are at a point in our economic history where everything is possible and I am completely convinced that even the challenges that we see today, are challenges that can be resolved very easily so long as we are all prepared to work together along with the same objectives.

Thank you very much.