VP’s Remarks At The 26th Edition Of MSME Clinics In Nasarawa State

SPEECH BY HIS EXCELLENCY, PROF. YEMI OSINBAJO, SAN, GCON, VICE PRESIDENT OF THE FEDERAL REPUBLIC OF NIGERIA AT THE 26TH EDITION OF THE MSME CLINICS IN NASARAWA STATE ON THURSDAY 10TH FEBRUARY, 2020.

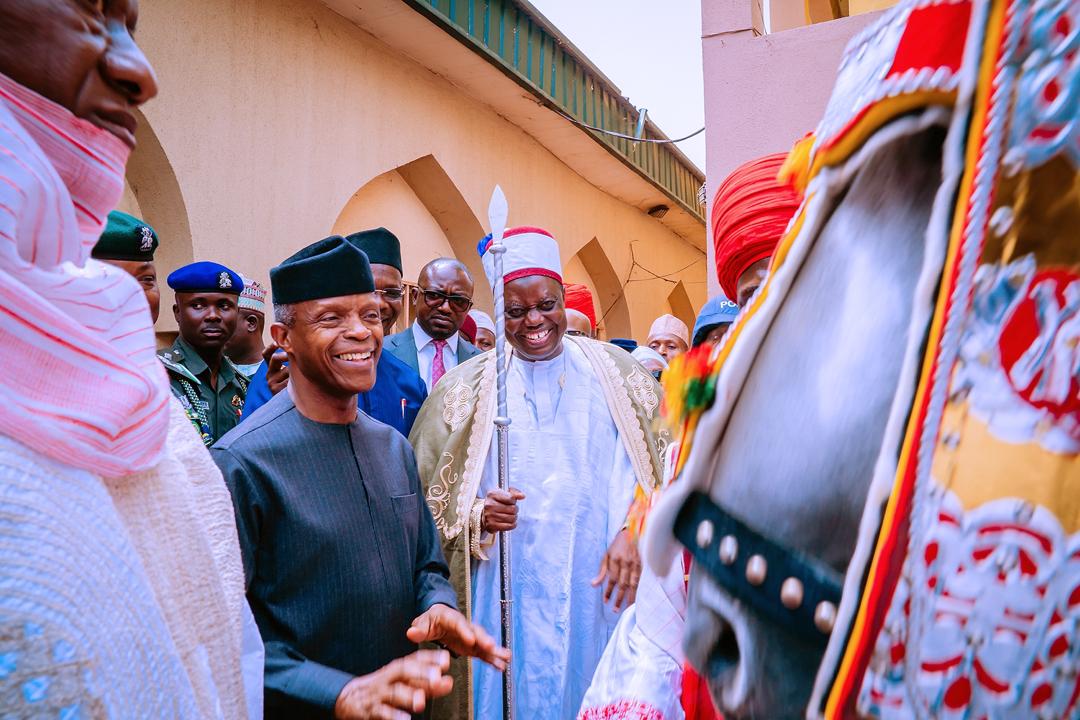

I would like to thank His Excellency the Governor, Abdullahi Sule and the entire government and people of Nasarawa state for the very warm welcome and the hospitality extended to me and to my delegation here today.

We would also like to thank His Excellency the Emir, who had hosted us earlier.

Your Excellency, it is my sincere and fervent wish that your clarity of vision demonstrated passionately for business and for the progress of this state will enable Nasarawa state to become truly the economic powerhouse of your dreams.

Last October, you and I and the Hon. Minister of State for Science and Technology visited a farm that started from 3 hectares in Nasarawa state which grew from 3 hectares with one and half million naira in 2017 but now occupies three thousand hectares and it is worth N1billion and employed over three hundred people.

What that tells us is that great things are happening here in Nasarawa state and with the support and partnership that you are creating, greater things would happen.

Our expectations are that this 26th edition of the National MSME Clinics holding here in this State would provide the further impetus that would give this whole process a business-friendly environment that would grow the State all of what it needs to actually come to fruition.

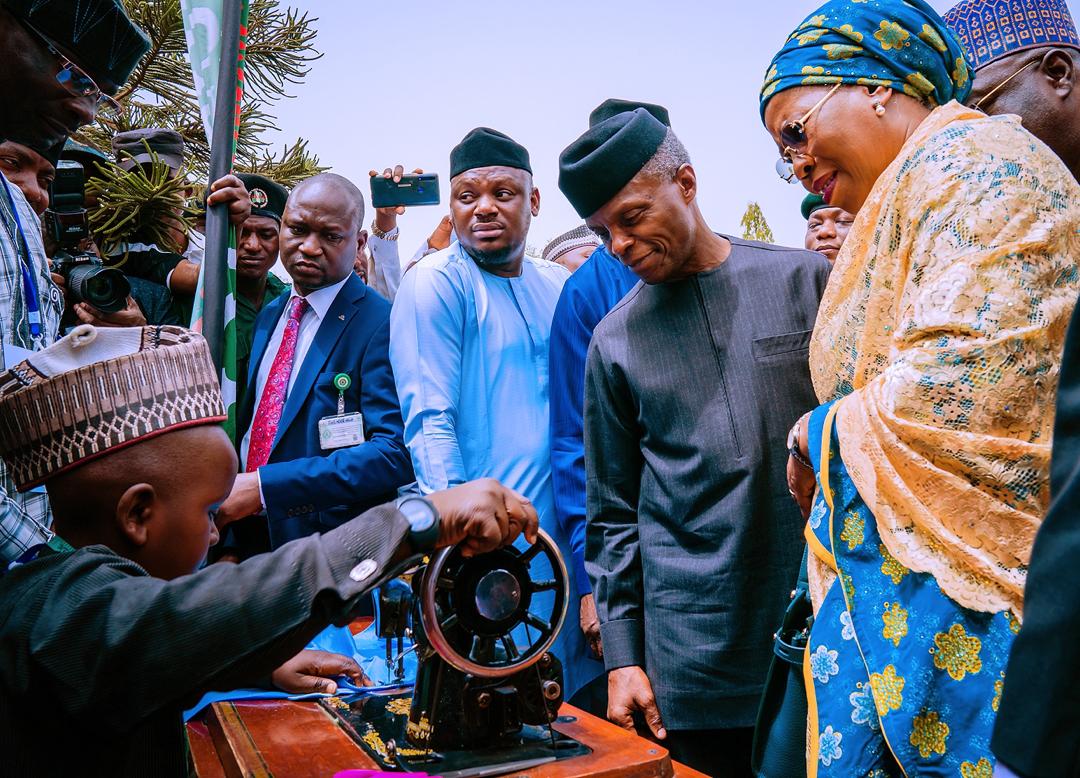

From what I have seen, from the creative and passionate law businesses that are participating in this cradle, I am confident that the economic transformation of Nasarawa state is well undermined. I want to emphasize that it is important for small businesses to take full advantage of the opportunities offered by the MSME Clinics.

Just as the MSME Clinics provide an opportunity for the Federal Government’s regulatory agencies to inform small businesses about the empowerment; their empowerment as well as business procedures, MSMEs are also expected to bring out their own challenges and their problems for possible solutions. That is why it is described as a clinic. It is same as a patient going to a hospital, complaining about whatever their problems are and expecting a solution.

It is still these kinds of symbiotic relationships that would be fulfilling the key purposes of organising these MSME clinics across Nigeria.

I would also urge the Nasarawa State Government, in fact, the Governor has said as much to build on the achievements of this cradles. Considering the work the creation of a once-stop-regulatory-shop for MSMEs in a suitable location in Nasarawa State.

Now, this would house NAFDAC, SON, CORPORATE AFFAIRS COMMISSION, and other regulators bring them close to the MSMEs in the State. All that would be required is a facility and the regulatory agencies would provide the rest. Second, the organization of State versions of the MSME Clinics, in view to this, this would help the State regulatory agencies also to key into the spirit and letter of the MSME Clinics. Already, I see that the Nasarawa State Government has incubation centres for growing business initiatives. This is excellent and could work very well.

But on the part of the Federal Government, we are also keen on establishing shared facilities and this would be established in about 2 years and we intend to establish it across the country, wherever we find a willing State.

The purpose of these shared facilities is to provide MSMEs with world-class business equipment in various commercial clusters. So, for example, for a shoe manufacturing facility, we would provide equipment that could have been ordinarily too expensive for an indigenous shoe manufacturer to buy for his own business, we would buy the equipment so many of the shoemakers and manufacturers would be able to use that same facility because each of indigenes would not be able to buy their own.

With such an arrangement in place, MSMEs are spared the financial burden of having to buy their own equipment especially the expensive equipment in order to be able to do business.

If possible, such shared facilities would be run on an immeasurable, sustainable business and we would expect that we would be able to pre-certify all of those shared facilities so that the regulatory agencies that the small businesses need to go to won’t have to bother about that because we would have pre-certified ahead of setting up the shared facilities.

The inspiration for the establishment of shared facilities arose from our interactions with the MSMEs during the past edition of the MSME clinics. Apart from the challenges that they face from regulatory agencies, another recurring occurrence is that small businesses across the country are not able to access production and operating equipment and this is why we thought it important to set up some of these shared facilities for their benefit.

Let me say also that the Federal Government is aware of the various regulatory challenges facing small businesses. And in some cases, even harassment and extortion by functionaries at different levels of Government.

We will be working within the ambit of the National Economic Council to address these issues. Meanwhile, I can give an example of how several agencies like CAC and BOI have taken the opportunity of the Clinics to improve their offerings to MSME. We are also working assiduously with the leadership of NAFDAC, SON, CAC to see that MSMEs get faster, cheaper and more efficient services from that Agency. The era of expensive and time-consuming access to NAFDAC certification will soon be over.

Meanwhile, I can give the example of how several agencies like CAC and BOI have taken the opportunity of the Clinics to improve their offerings to small businesses (MSME.)

We are also working assiduously with the leadership of NAFDAC, SON and CAC to see that MSMEs get faster, cheaper and more efficient services from those agencies. The era of expensive and time-consuming access to NAFDAC certification should soon be over.

I am sure you are well aware of the Federal Government fresh initiatives at creating a more favourable environment for small businesses.

The first is in the gradual reduction in interest rates through some the modifications by the CBN on restrictions to access to treasury bills and modifications to Open Market Operations of the CBN which has brought fixed income yields down to between 5 and 6%. That has helped greatly in reducing interest rates for business owners. So, we expect to see that interest rate for commercial loans would go down gradually and very slowly. We might even be able to get single digits interest rates for commercial users.

The second incentive is the new tax incentives under the Finance Act. As you know, the President just signed it to into law.

The Act exempts small companies with a turnover of less than N25million a year from the Companies Income Tax. Medium-sized companies with turnover of between N25million to N100million a year will now pay Companies Income Tax at a lower rate of 20%. So, any small company; all small companies do not have to pay cooperation tax because their turn over is less than N25million. Companies who have a turn over of between N25million and N100million would now pay per year and will now pay Companies Income Tax at a lower rate of 20 percent. That is almost 10 percent off of the original rate.

Another business-friendly provision which is in the Finance Act is the granting of tax credits to companies for early filing of their tax returns. So, if you are a company, especially, a mid range company that has to pay taxes, and you found your tax returns early, you can actually get as much as a 2 percent discount on your tax just for filing your tax returns early.

Large companies will get a 1% tax credit while medium-sized companies will get a 2% tax credit.

Perhaps the most publicised aspect of the Finance Act is the increase in the rate of Value Added Tax (VAT) from 5% to 7.5%. Many people have said, oh, this is a hard tax burden on the consumer and implications for those who are trading as well. But, we must remember that this is still one of the lowest, in fact, it is the lowest VAT rate in Africa.

While it is true that Ghana for instance recently reduced its VAT rate from 15% to 12.5%, ours is 7.5 %.

It is also important to mention that companies (again small companies, MSMEs) with a turnover of less than N25million do not have to register for VAT. In other words, their businesses don’t have to be registered for VAT. So, that way, it is possible that the government has worked out a way of not creating any extra burdens for small and medium-sized companies.

In addition to that, in order to reduce the impact of VAT increase on consumers several basic items such as food, drugs and educational items are exempted from VAT. So, there is no payment (VAT on food, on drugs and education as I told you.)

There is also another upside to the increase in VAT. And this is that additional revenue would now go to the State for VAT. So, the State would be able to earn additional revenue.

Now, that revenue is important to the States, so that they can do amongst others; at least begin to pay the new minimum wage. This way, it would improve consumer spending as well and it would work very well for everyone.

So, I think that despite the increase in VAT, there are so many inbuilt advantages for small businesses. I believe that small businesses can take advantage of the new provision in order to take their businesses so it can be better.

In closing, I wish to congratulate the Nasarawa State Government for organizing a successful MSME Clinic and also to commend all the participating MSMEs for making use of the opportunities given to them by this MSME Clinic.

I urge all our MSMEs to present themselves during this year’s 3rd National MSME Awards, participate in it, present your products in this award. The prizes this year are bigger and better than that of last year.

Of course, the competition for such rewards is also keener. The intention this year is to have an MSME week with several activities climaxing with the MSME Awards.

The President is determined to create a Nigeria in which small business owners are nurtured and encouraged to thrive and prosper

Our first responsibility as regulatory agencies of the government is to support their growth or enable them as best as possible.

So, I would like to thank the Governor again, and all of you again for this very successful outing that emerged from this activity. At this point, I also have a very pleasurable duty to perform which is to inaugurate the Nasarawa State Enabling Business Environment Council.

As you know Mr. President Muhammadu Buhari had established the Presidential Enabling Business Environment Council to do all that would be necessary to ensure that businesses have the best environment to flourish and prosper. I am privileged to chair PEBEC which is the Presidential Business and Economic Council. And we have Dr. Jumoke Oduwole here, who is the Special Adviser to the President and who is also the Secretary to PEBEC.

But the work of creating an enabling business environment cannot be done without the States. The States would do their very best when also they set up their own enabling business environment councils. And this is what Governor Abdullahi Sule has done and he chairs the Nasarawa State Enabling Business Environment Council and he has taken it upon himself to chair that Council. So, the Council works in synergy and in collaboration with the Presidential Enabling Business Environment Council.

So, it is my very special pleasure, first, to invite the Governor to join the Nasarawa State Enabling Business Environment Council to perform the inauguration.

So, I would formally inaugurate this Nasarawa State Enabling Business Environment Council led by His Excellency, the Governor of Nasarawa State, Engineer Abdullahi Sule. I inaugurate the council for the benefit of the people of Nasarawa State and to the Glory of God.

God bless you and thank you very much.